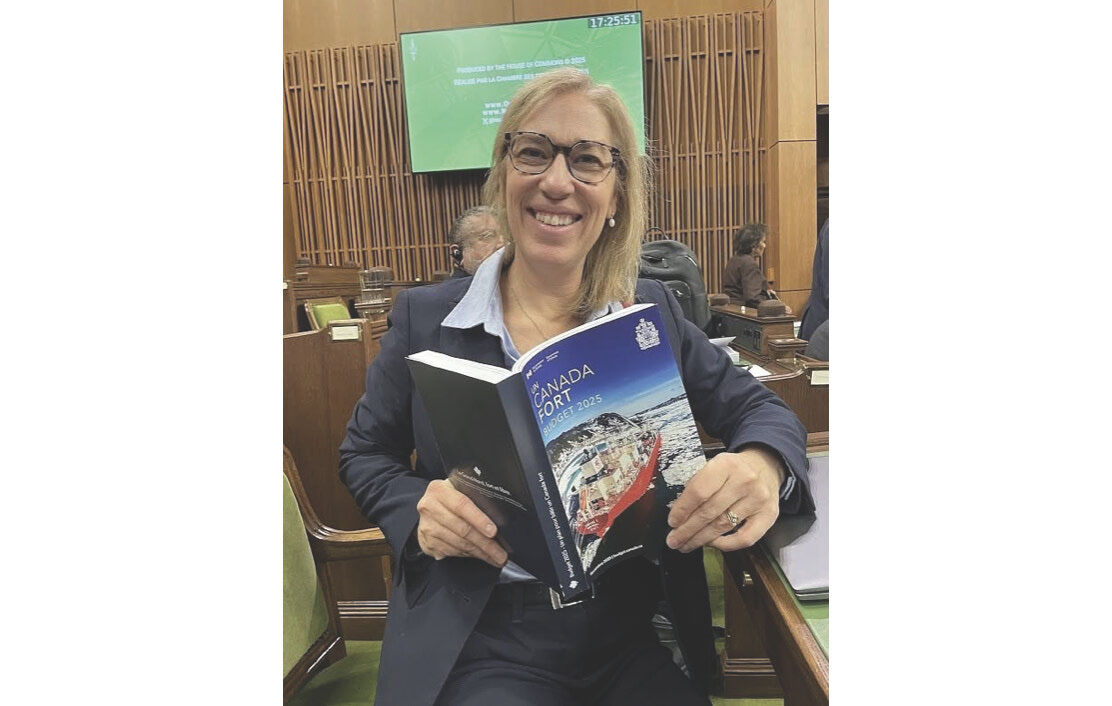

Sophie Chatel breaks down what the federal budget means for the Pontiac

Tashi Farmilo

Canada’s 2025 federal budget, tabled on November 4, arrives during a period of rising costs, slow growth and renewed global trade tensions. For Pontiac’s Member of Parliament Sophie Chatel, the national plan holds significant local potential.

“This budget is about building,” said Chatel. “We’re investing in infrastructure, in homes, in people, and in doing it in a way that strengthens Canadian communities.”

One of the largest spending areas is housing. The federal government is committing billions to build more homes, with a focus on affordability. Municipalities that present ready-to-go projects with essential services like water and sewage can access support. Pontiac towns, often limited by aging infrastructure, could benefit directly.

“If you want more homes in rural areas, you need to invest in infrastructure in small municipalities,” Chatel said. “They just don’t have the fiscal capacity to do that alone. That’s why we’re also looking at prefab partnerships. Bringing in ready-to-assemble homes can speed things up and make housing more affordable.”

Clean energy projects are also a focus. Local solar initiatives, such as those proposed by the MRC, may qualify under new federal investment programs. “There are massive investments coming in clean energy,” said Chatel. “If we can bring prefab homes powered by solar to rural areas, we’ll do it.”

The budget prioritizes Canadian-made products. That includes lumber from local mills, which have been hit by ongoing softwood tariffs. “Everything we build will use Canadian wood, Canadian steel, Canadian workers,” she said.

To support local food production, the budget includes a “super tax deduction” that lets businesses fully expense the cost of machinery and expansion in the year they invest.

“I bought a jar of pickles the other day. The cucumbers were grown in Ontario, but they were processed and packaged in Germany,” Chatel said. “By manufacturing these foods ourselves, we create jobs and keep more value here in Canada.”

She pointed to Pontiac’s dairy and grain processors as examples of businesses ready to grow. “They just need the tools to make it viable, and this measure helps by cutting the upfront cost of scaling up,” she said.

To help with rising household costs, the budget lowers the lowest federal income tax rate from 15 to 14 percent. The change is expected to save a two-income household up to $840 per year. “It’s a way to help people deal with food prices and the rising cost of living,” said Chatel.

School meals are also part of the plan. The national food program will provide healthy lunches in participating schools. Chatel expects most Pontiac schools to qualify. “Kids will get healthy meals; parents save money; and local farmers get more business. It’s a win-win and it’s a full-circle benefit.”

Dental care coverage has also expanded. “That’s 20,000 people in my riding who now have access to dental care,” she said. “That’s a real, tangible change.”

On public service jobs, which many Pontiac residents rely on, Chatel said the government is avoiding harsh cuts. “Most workforce reduction will come through early retirement. It will be done with care and compassion.”

The budget includes investments in digital tools and AI to improve public service delivery, while supporting younger workers and modernizing operations.

National defence spending, though less visible, could benefit local manufacturers. Companies in Quebec that produce boots, drones or other tech components may see new opportunities. “Defence is a big economy,” said Chatel. “That kind of investment creates jobs here.”

While the programs and funding are national, Chatel believes Pontiac is well positioned to take part if its communities and businesses are ready. “Everything that’s in the budget was in our platform. We’re doing what Canadians asked us to do,” she said. “Now we just need to deliver.”