Gatineau attributes new vehicle registration tax to provincial government

Taylor Clark

Despite pushback from officials and a petition of more than 1,100 signatures, Gatineau municipal council moved forward with its new vehicle registration tax to finance public transportation.

Come January 2025, Gatineau motorists will be expected to pay $60 for every vehicle registered in Quebec. The funds collected would be used to absorb the Société de transport de l'Outaouais’ $10 million structural deficit. The following year, another $30 will be added to finance service improvements.

Highly contested by citizens since its introduction, the tax has been the subject of numerous debates over recent months, until the measure was finally adopted 13 to 5 on May 14 at city council. Opposing the measure was district councillors Gilles Chagnon, Mike Duggan, Denis Girouard, Jean Lessard, and Mario Aubé.

Masson-Angers district councillor Aubé still had hope that the Government of Quebec would "take out its cheque book and take its responsibility when it comes to pubic transportation."

“Cities are not banks. Gatineau motorists are not banks either. Yes, cities have long called for diversity of income, but not to the point of cutting the throats of motorists,” said Aubé.

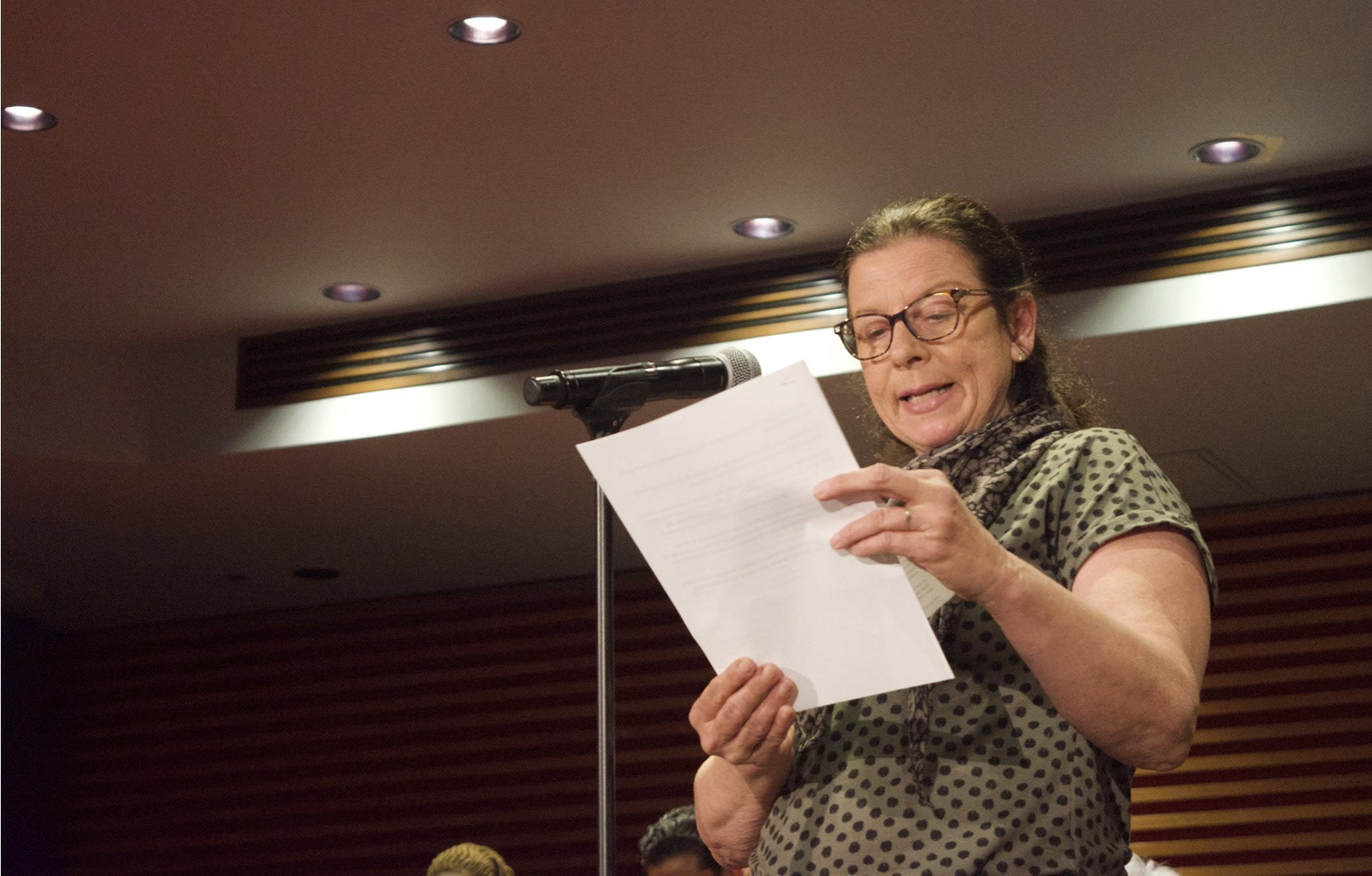

Leading the charge of citizens against the tax was Suzanne Bisson, who, along with her petition of more than 1,100 signatures, urged council to find another solution other than taxing those who are already “suffocating.”

“We have people who are suffering and households who are unable to provide for basic needs, but the only solution we find is to use a system which, in my opinion, has now become abusive to resolve problems of poor management of the (Société de transport de l'Outaouais),” Bisson told council during the question period.

She stressed the fact that many motorists had no choice but to use their vehicles. “Isn’t it discriminatory to target only one group? Why not impose this tax on the entire population of the Ville de Gatineau at the same time as recovering funds from fraudsters with Ontario plates?”

Described as a “poisoned chalice” from the provincial government, acting Gatineau mayor Daniel Champagne said the City had no choice but to make up the structural deficit left behind by Quebec.

“The reason why $10 million is missing is not because it is poorly managed,” added municipal council president Steven Boivin. “It’s because the Government of Quebec is not giving its share. Then, we find ourselves in this position where we must go and tax people.”

When it came to Ontario plates, Boivin also pointed the blame to Quebec, stating the provincial government was not doing its job. “It’s the provincial (government) who is not going to get its own money … We are as angry as you. This is why we are passing the resolution today to say, ‘Do something, it makes no damn sense.’”

The resolution demanded actions to regulate the impact arising from the presence of Gatineau residents who own vehicles registered in Ontario.

Although the tax was passed by council, Gatineau has until September to specify the exact amount to the Société de l'assurance automobile du Québec.

Photo caption: Gatineau resident Suzanne Bisson speaks out against the vehicle registration tax officially imposed by council during its proceedings on May 14.

Photo credit: Taylor Clark